Fiberglass Pipes Market Trends & Segment Insights to 2033

Report Overview:

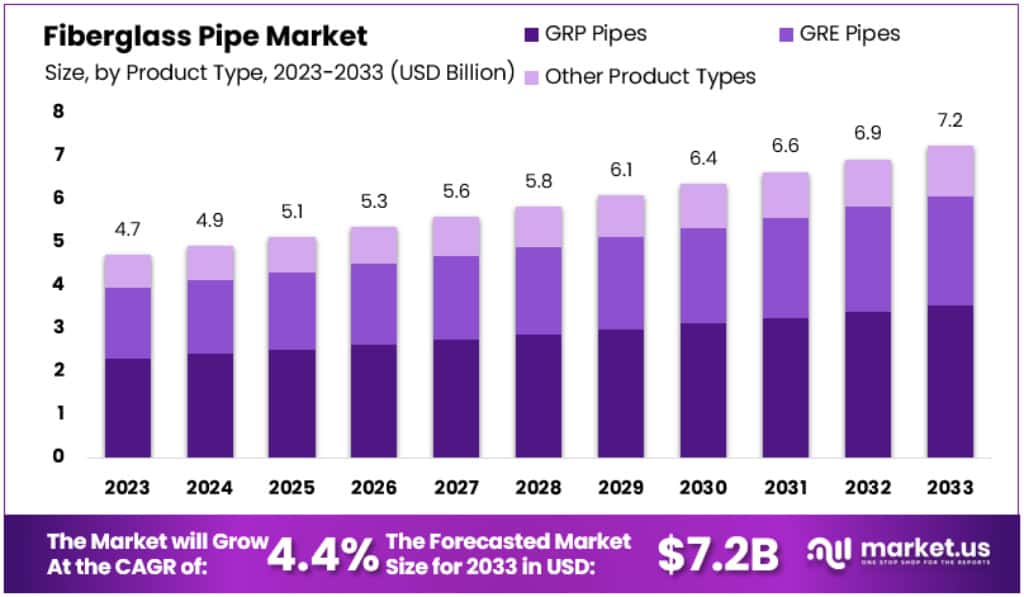

The global fiberglass pipes market is projected to reach approximately USD 7.2 billion by 2033, rising from an estimated USD 4.7 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 4.4% over the forecast period from 2024 to 2033.

Fiberglass pipes, also known as glass-reinforced plastic (GRP) or fiber-reinforced plastic (FRP) pipes, are made by combining glass fibers with thermosetting resins. This blend results in a durable, lightweight, and corrosion-resistant alternative to traditional materials like steel and concrete. Originally adopted by energy companies for saltwater injection and flowline systems, these pipes have expanded into other sectors such as desalination, chemical processing, and municipal water distribution largely due to the high maintenance costs associated with metal piping.

Key Takeaways:

The Global Fiberglass Pipes Market is expected to reach approximately USD 7.2 Billion by the year 2033, up from USD 4.7 Billion in 2023.

This growth is forecasted at a CAGR of 4.4% during the period from 2024 to 2033.

In 2023, GRE pipes held a substantial market share of 47.9%, especially suitable for high-pressure and high-temperature applications.

E-glass fiber accounted for over 55% of the market share in 2023, known for its exceptional resistance to acidic corrosion.

North America dominated the Fiberglass Pipes Market in 2023 with a 36% Share and a market value of USD 1.6 billion.

China’s shift from coal to natural gas creates opportunities for fiberglass pipes in energy transportation.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/fiber....glass-pipe-market/fr

Key Market Segments:

By Product Type

GRP Pipes

GRE Pipes

Other Product Types

By Fiber Type

T/ S/ R Glass

E-glass

Other Fiber Types

By End-Use

Oil & Gas

Chemicals

Sewage

Other End-Uses

Drivers

Demand for fiberglass pipe often referred to as GRP or FRP continues to climb as public utilities and private operators look for pipelines that handle corrosive fluids, elevated pressures, and harsh environments better than carbon steel. A major boost is coming from renewed investment in energy infrastructure. According to a 2023 International Energy Forum survey, spending on upstream and midstream assets in hydrocarbon‑producing regions is rebounding at roughly 7 8 percent per year. In this setting, operators favor fiberglass for flowlines, water‑injection lines, and produced‑water handling because it withstands sour crude, CO₂‑rich gas, and high‑salinity brines. Weighing about two‑thirds less than comparable steel pipe, a GRP gathering line can be placed with lighter equipment, trimming site labor by 10 -20 percent and lowering transport emissions.

Desalination and district‑cooling projects provide a second growth engine. Gulf Cooperation Council nations plan to add over 15 million m³ per day of new desal‑plant capacity by 2030, and GRP has become the preferred material for seawater intake and brine‑discharge lines, resisting chloride attack at a fraction of stainless‑steel weight. Large‑diameter (up to 3 m) GRP mains are also common in district‑cooling networks across the UAE, Saudi Arabia, and Singapore, where their smooth bore cuts pumping energy by roughly 5 percent over a 30‑year life.

Restraining Factors

Despite its advantages, fiberglass pipe faces several hurdles that can slow adoption particularly in cost‑sensitive or risk‑averse markets. First is the high upfront cost: depending on pressure class and resin system, a fiberglass spool can cost two to three times more per meter than standard carbon steel or ductile iron in low‑pressure service. Budget‑constrained municipalities often balk at that premium, even if life‑cycle savings are favorable.

Installation complexity poses another barrier. Proper field winding, adhesive bonding, or lamination requires skilled crews and tight environmental control during curing. Regions lacking trained installers risk joint leaks or structural flaws, whereas steel or HDPE systems benefit from a wider labor pool familiar with welding or electrofusion.

In sunny climates, UV exposure can degrade poorly protected GRP: damaged gel coats may lead to resin micro‑cracking or embrittlement, eroding confidence in long‑term durability for above‑ground lines.

Opportunities

Beyond traditional oil, gas, and water service, new markets are opening. The most promising is the hydrogen economy. Industry trackers list over 90 GW of green‑hydrogen electrolyser projects slated for operation by 2035. Hydrogen readily permeates steel and causes embrittlement, but epoxy‑ or vinyl‑ester‑based composites with tailored glass fabrics show superior resistance. Trials demonstrate safe transport of pure hydrogen at 30 bar with none of the micro‑cracking seen in steel. Products certified to updated hydrogen-service standards (e.g., ISO 14692 revisions) could tap into a pipeline segment expected to exceed USD 15 billion by 2040.

Carbon capture, utilization, and storage (CCUS) is another avenue. Dense‑phase CO₂ with trace contaminants is highly corrosive, yet modified GRP with anti‑permeation layers performs well in Gulf Coast and North Sea pilots. Analysts forecast more than 40,000 km of CO₂ pipelines by 2050; even a 10 percent composite share could surpass USD 3 billion in today’s prices.

Additional prospects include green‑ammonia export terminals, offshore fire‑water retrofits with spoolable composite pipe, and trenchless slip‑lining for aging municipal sewers all areas where GRP’s corrosion resistance and low weight translate into faster installation and lower maintenance.

Trends

Several key trends are reshaping the fiberglass‑pipe landscape. First is the move to large‑diameter sections over 2 m for seawater intakes, outfalls, and industrial effluent tunnels, displacing concrete and steel while slashing installation time through filament‑wound, high‑stiffness designs.

Second is the rise of smart piping. Manufacturers now embed fiber‑optic strain or temperature sensors inside the laminate, enabling real‑time monitoring of pressure spikes, joint stress, and fatigue. This digital layer supports predictive maintenance, particularly in critical systems such as offshore fire‑water networks or nuclear‑plant cooling circuits.

Third, sustainability goals are steering buyers toward GRP made with bio‑based resins and recycled glass fibers, aligning with ESG targets and green‑building certifications.

Finally, modular “pipe‑in‑pipe” solutions are gaining ground in data‑center cooling loops and LNG terminals. Pre‑assembled GRP carrier lines inside containment sleeves arrive on site ready for rapid hookup, compressing construction schedules and minimizing hot‑work permits. Collectively, these trends point to a future where fiberglass piping is not only corrosion‑proof and lightweight but also smarter, greener, and faster to deploy.

Market Key Players:

National Oilwell Varco Inc.

Graphite India Limited

PPG Fiberglass Industries

HOBAS International GmbH

Fibrex Corporation

Andronaco Industries

Future Pipe Industries

Sarplast SA

FCX Performance

Amiblu Holding GmbH

Chemical Process Piping Pvt. Ltd. (CPP)

Saudi Arabian AMIANTIT Company

Other Key Players

Conclusion

Fiberglass pipes have evolved from specialized flowline applications into a widely accepted solution for transporting corrosive fluids and in weight-sensitive environments. Their strength lies in offering long-term cost savings, excellent resistance to aggressive chemicals, and ease of handling all of which make them an ideal choice for upcoming projects in water infrastructure, clean energy, and industrial development.

Although challenges such as higher initial costs, limited installer expertise, and variability in material quality still affect adoption in some regions, these obstacles are gradually being addressed. Progress in resin formulations, improved jointing systems, and better on-site training are closing the gap. As long as manufacturers uphold high performance standards and consistently demonstrate long-term durability, fiberglass pipes are well-positioned to become a key component in building more resilient and sustainable infrastructure worldwide in the years ahead.

Ferulic Acid Market Highlights | Size, Growth, and Key Drivers

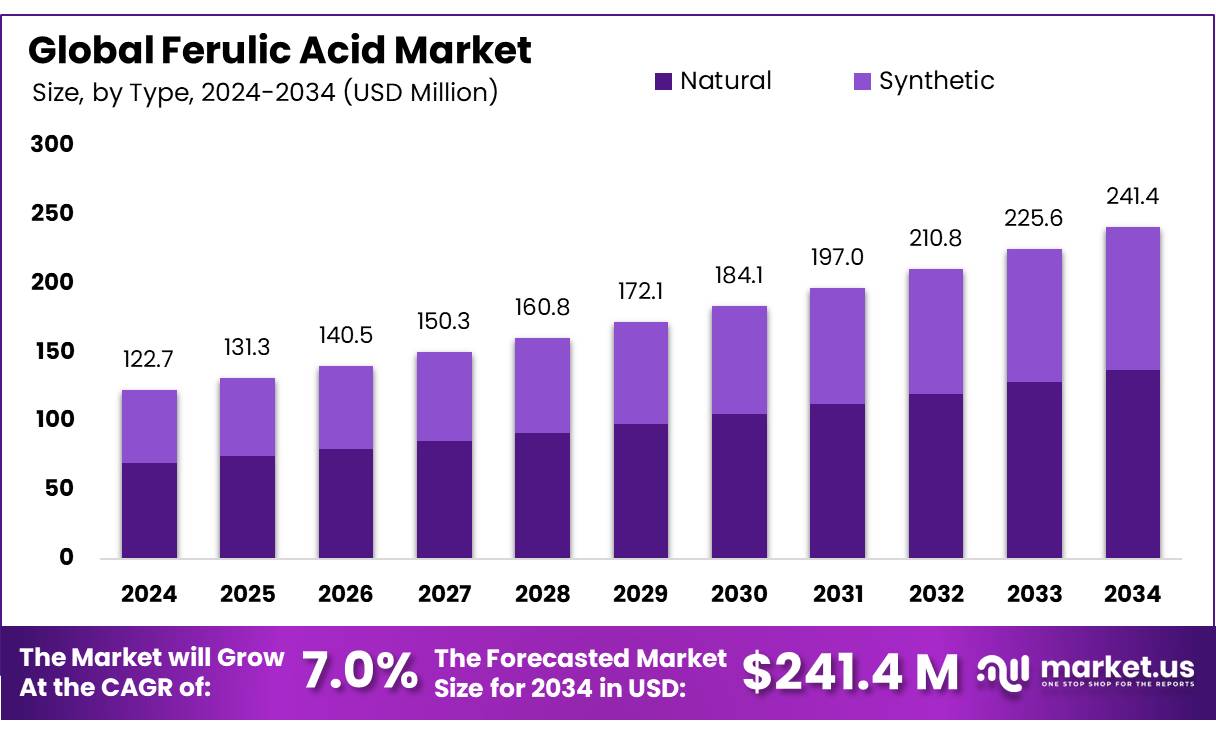

The global Ferulic Acid Market is projected to reach approximately USD 241.4 million by 2034, increasing from an estimated USD 122.7 million in 2024. This growth reflects a compound annual growth rate (CAGR) of 7.0% over the forecast period spanning 2025 to 2034.

The global ferulic acid market is witnessing steady growth, primarily driven by increasing demand in the cosmetics, pharmaceutical, and food industries. Known for its powerful antioxidant properties, ferulic acid is widely used in anti-aging skincare products and health supplements. Its ability to neutralize free radicals and stabilize other active ingredients like vitamins C and E makes it highly valuable in formulation development. As consumer preference shifts toward natural and plant-based ingredients, ferulic acid often derived from rice bran, oats, and other grains is gaining traction. The market outlook remains positive, with expanding applications and innovation supporting its long-term growth.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/ferul....ic-acid-market/free-

Ferrochrome Market Share & Regional Trends Analysis

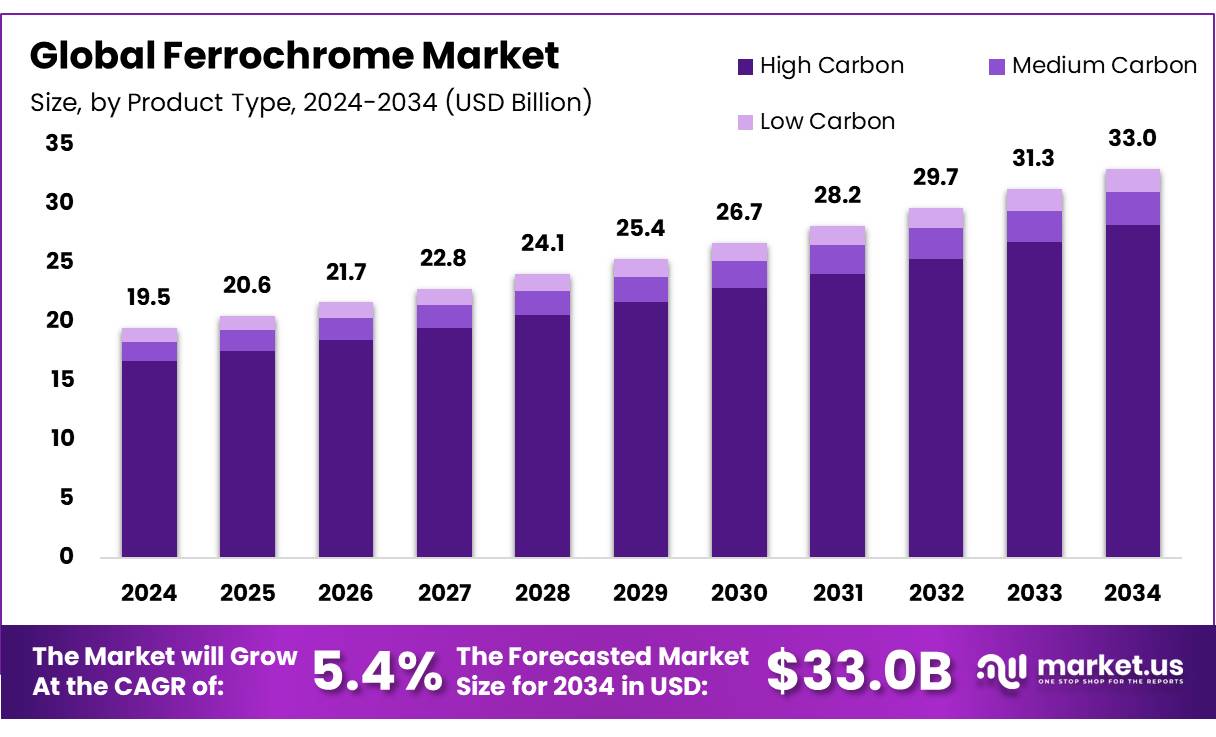

The global ferrochrome market is projected to grow significantly, rising from an estimated USD 19.5 billion in 2024 to approximately USD 33.0 billion by 2034. This growth reflects a compound annual growth rate (CAGR) of 5.4% over the forecast period from 2025 to 2034, driven by increasing demand in the stainless steel industry and infrastructure development worldwide.

The global ferrochrome market is experiencing steady growth, fueled by rising demand for stainless steel across sectors like construction, automotive, and industrial manufacturing. Ferrochrome, an essential alloying material in stainless steel production, enhances durability and corrosion resistance making it vital for modern infrastructure. Regions such as Asia-Pacific are leading consumption due to rapid urbanization and industrial expansion. Additionally, environmental pressures are accelerating the shift toward low-carbon ferrochrome and greener production technologies. As sustainability becomes central to steelmaking practices, the ferrochrome market is evolving to align with both economic needs and global climate goals, paving the way for long-term growth.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/ferro....chrome-market/free-s

Sustainable Growth in Feed Enzymes Market | Innovations & Regional Trends

Report Overview:

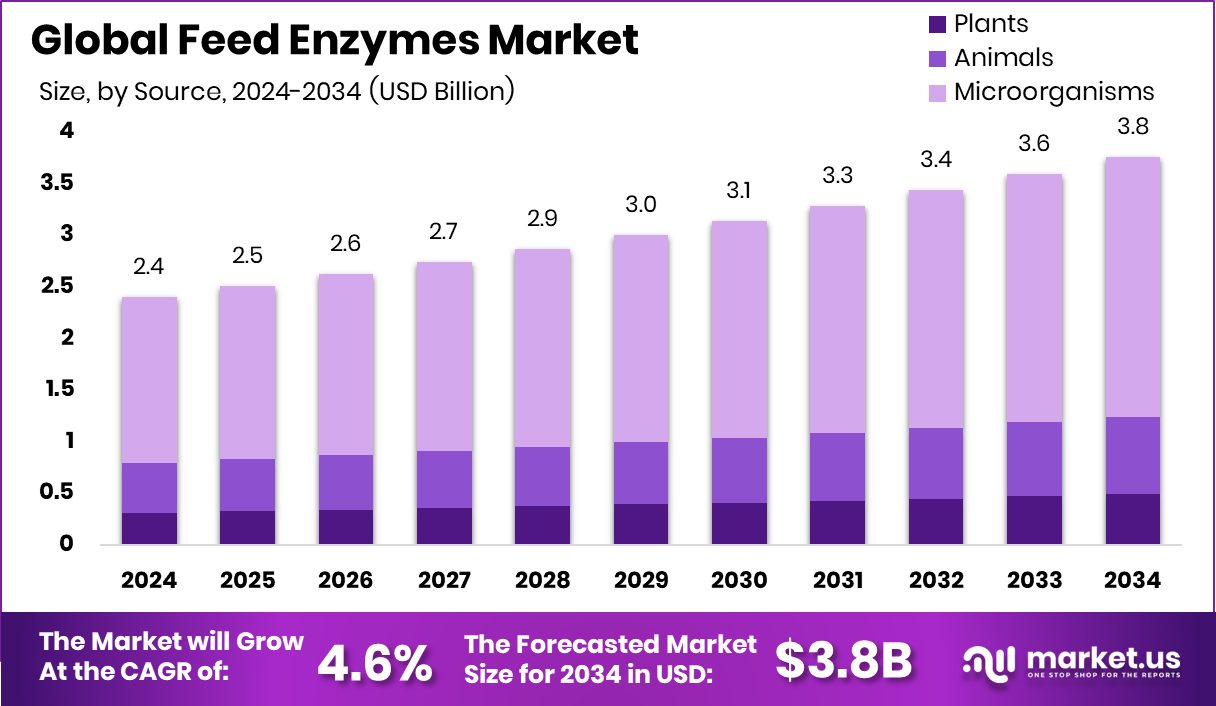

The Global Feed Enzymes Market is projected to reach approximately USD 3.8 billion by 2034, rising from USD 2.4 billion in 2024, with a steady compound annual growth rate (CAGR) of 4.6% between 2025 and 2034. Asia-Pacific continues to lead the market, holding a dominant 46.30% share, largely driven by the strong uptake of feed enzymes in poultry farming across the region.

The global feed enzymes market plays a crucial role in supporting the livestock and aquaculture sectors by incorporating functional enzymes into animal feed. These enzymes help animals digest their feed more efficiently by improving nutrient absorption, promoting healthier growth, and reducing overall feed waste. Commonly used enzymes such as phytase, protease, and carbohydrase help break down complex elements like phosphorus, proteins, and carbohydrates, making them easier for animals to absorb and utilize.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/globa....l-feed-enzymes-marke

2023-2032 Global EPP Foam Market Analysis by Applications & Form

Report Overview:

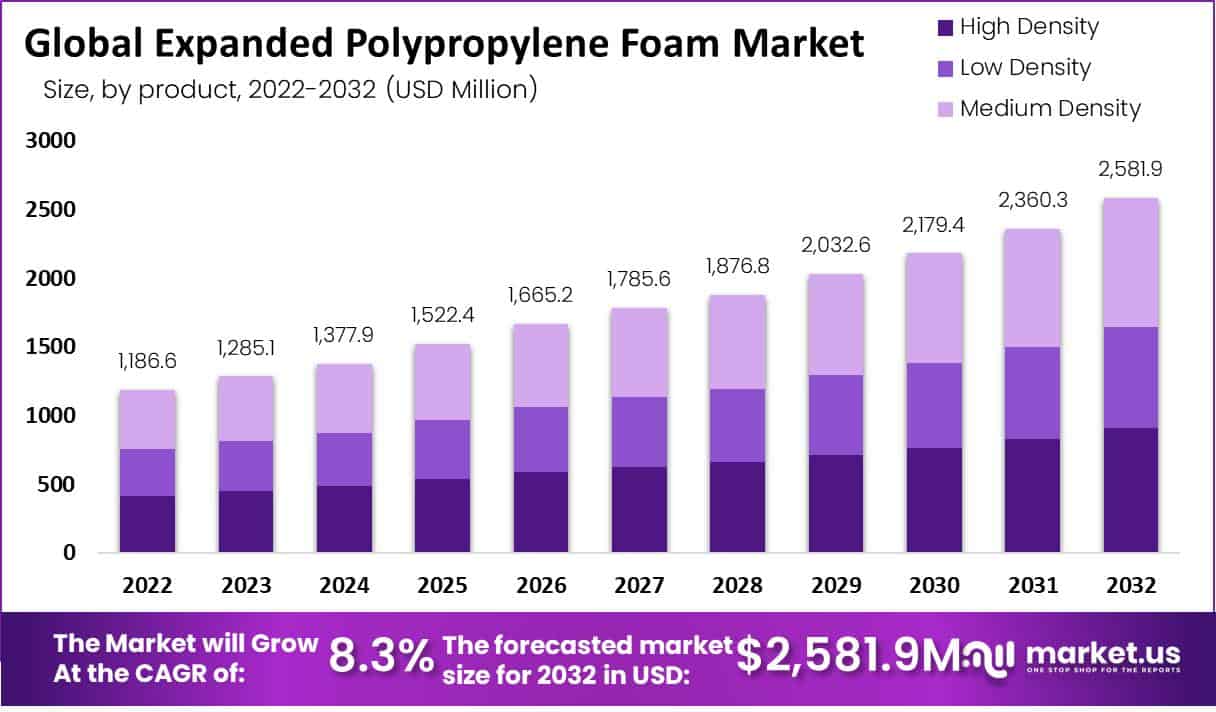

In 2022, the global expanded polypropylene (EPP) foam market was valued at approximately USD 1,186.6 million. It is projected to grow significantly, reaching around USD 2,581.9 million by 2032. This growth reflects a strong compound annual growth rate (CAGR) of 8.3% during the forecast period from 2023 to 2032.

The global Expanded Polypropylene (EPP) Foam market is experiencing robust growth, fueled by increasing demand for lightweight, durable, and eco-friendly materials across various industries. Renowned for its superior impact resistance, thermal insulation, and recyclability, EPP foam is widely used in sectors such as automotive, packaging, construction, and consumer products. As industries place greater emphasis on sustainability and energy efficiency, EPP is gaining traction for its ability to deliver both environmental and economic value over time. With the global push for efficient, protective, and lightweight solutions, the EPP foam market is set to expand steadily in the coming years.

Key Takeaways:

The global expanded polypropylene foam market is projected to experience steady expansion through 2032 with an expected compound annual growth rate (CAGR) of 8.3% from 2023-2032.

Expanded polypropylene foam has seen increasing popularity due to an emphasis on eco-friendly and lightweight materials, prompting rising market demands in various applications.

The expanded polypropylene foam market can be divided into high density, low density, and medium density segments; among these categories, high-density was by far the market leader, accounting for 42.0% market share as of 2022.

Bumpers applications were the clear market leaders, accounting for 42% of market revenue in 2022 due to rising use in automotive applications of expanded polypropylene foam.

EPP foam finds widespread application in automotive components due to its cost-effectiveness, impressive mechanical properties and malleability properties which allow potential weight savings of 10% for up to 7% fuel savings! This leads to potential reduction of vehicle weight.

Asia Pacific held the highest market share for expanded polypropylene foam sales accounting for 40.0 % of revenue generated worldwide.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/expan....ded-polypropylene-fo

Key Market Segments:

Based on Product

High Density

Low Density

Medium Density

Based on Application

Bumpers

Roof Pillars

Seat Bracing

Armrests

Other Applications

Based on End-User

Automotive

Packaging

Consumer goods

Appliances

Oil & Gas

Other End-Users

Drivers

The global Expanded Polypropylene (EPP) foam market is witnessing steady growth, largely driven by its exceptional combination of lightweight structure, impact resistance, and thermal insulation. One of the primary contributors to this demand is the automotive industry, where EPP is extensively used in components such as bumpers, headrests, door panels, and seating. These applications benefit from the foam's shock-absorbing capabilities and durability, which not only enhance passenger safety but also support vehicle lightweighting an increasingly important factor in the push for greater fuel efficiency and electric vehicle optimization.

Another major growth driver is the rising need for sustainable and protective packaging solutions. EPP foam is reusable, recyclable, and offers superior protection, making it a preferred choice for packaging sensitive items like electronics, appliances, and medical devices. As online retail and global shipping accelerate, the demand for high-performance, lightweight packaging continues to climb.

The construction sector is also contributing to market expansion. EPP foam is being incorporated into energy-efficient insulation systems, acoustic panels, and soundproofing materials. Growing attention to green building standards and stricter energy efficiency regulations are boosting the need for high-performing materials like EPP in modern construction projects.

Restraining Factors

Despite its many advantages, the EPP foam market faces a few key limitations. One major barrier is the higher production cost compared to alternatives such as Expanded Polystyrene (EPS). Manufacturing EPP involves more complex processing and costlier raw materials, which can discourage use in budget-sensitive sectors or developing regions.

Supply chain instability, particularly fluctuations in the availability and cost of polypropylene resin, poses another challenge. Since polypropylene is derived from petroleum, shifts in crude oil pricing and refinery output can directly impact EPP costs, affecting both profitability and project timelines.

Additionally, awareness about EPP’s benefits remains limited in some regions. Many smaller manufacturers and businesses still opt for cheaper, more familiar alternatives due to a lack of technical knowledge or exposure. Infrastructure for EPP recycling is also unevenly developed across countries, reducing the material's appeal in regions where end-of-life reuse or recycling isn't readily available, despite EPP's strong sustainability credentials.

Opportunities

The EPP foam market is well-positioned for future growth, thanks to emerging applications and increasing demand for sustainable materials. One of the most promising opportunities lies in the electric vehicle (EV) sector. As global EV production scales up, automakers are searching for lightweight, high-performance materials that enhance safety and thermal protection. EPP foam is ideal for use in battery enclosures, crash zones, and structural components offering strong growth potential in this space.

Sustainability trends are also opening doors for bio-based and recycled EPP products. As businesses and regulators push for greener alternatives, innovations in bio-sourced polypropylene and post-consumer recycled content are gaining momentum. These developments align with circular economy goals and offer a chance to reduce reliance on virgin plastics.

Moreover, expanding sectors like consumer electronics and healthcare are increasing demand for protective and thermally stable packaging. EPP’s shock absorption and insulating properties make it a top choice for shipping sensitive goods such as diagnostic kits, medical devices, and electronics.

In construction, EPP is gaining traction in applications like modular housing, HVAC insulation, and soundproofing systems. With the global focus on sustainable urban development and energy-efficient infrastructure, the market potential for EPP in the building sector continues to grow.

Trends

The EPP foam market is evolving with several trends shaping its direction. Foremost among these is the push toward lightweighting in sectors such as automotive and aerospace. EPP's strength-to-weight ratio makes it a natural choice for reducing overall vehicle mass without compromising safety or durability critical for improving energy efficiency and meeting emissions targets.

There is also a notable shift toward environmentally friendly materials. Manufacturers are increasingly investing in the production of bio-based and recycled EPP foam, responding to regulatory changes and consumer demand for sustainable alternatives. These materials are gaining traction in sectors such as packaging, construction, and consumer goods.

Smart packaging and thermal-sensitive logistics are becoming high-growth areas. EPP’s insulating properties make it ideal for maintaining temperature stability during the transport of perishable food, pharmaceuticals, and electronics especially important as cold chain logistics and e-commerce expand worldwide.

In the electronics industry, EPP foam is being used for protective packaging in high-tech devices due to its antistatic, thermally stable, and shock-absorbing features. The ongoing trend of miniaturized electronics further increases the need for precisely molded, form-fitting protective materials like EPP, ensuring continued innovation in product design and application.

Market Key Players:

JSP

BASF SE

Kaneka Corporation

DS Smith

Furukawa Electric Co., Ltd.

Hanwha Group

Sonoco Products

Knauf Industries

Izoblok

Dongshin Industry Incorporated

Clark Foam Products Corporation

Paracoat Products Ltd.

Molan-Pino South Africa

Signode Industrial Group LLC

Armacel

Furukawa Electric Co., Ltd.

Other Market Players

Conclusion

The Expanded Polypropylene (EPP) Foam market is experiencing strong growth, driven by its outstanding qualities such as durability, impact resistance, thermal insulation, and recyclability. With industries like automotive, packaging, construction, and consumer goods shifting toward lightweight and environmentally friendly materials, EPP foam is emerging as a top choice. Its adaptability and long-lasting performance make it well-suited to today’s sustainability targets and circular economy frameworks.

While the market does face obstacles such as relatively high production costs and uneven recycling infrastructure ongoing improvements in manufacturing processes and a growing recognition of EPP’s long-term benefits are helping to ease these concerns. Rising demand from sectors like cold chain logistics, electric mobility, and smart packaging is further fueling the market’s expansion.